Georgia Sales Tax Calculator

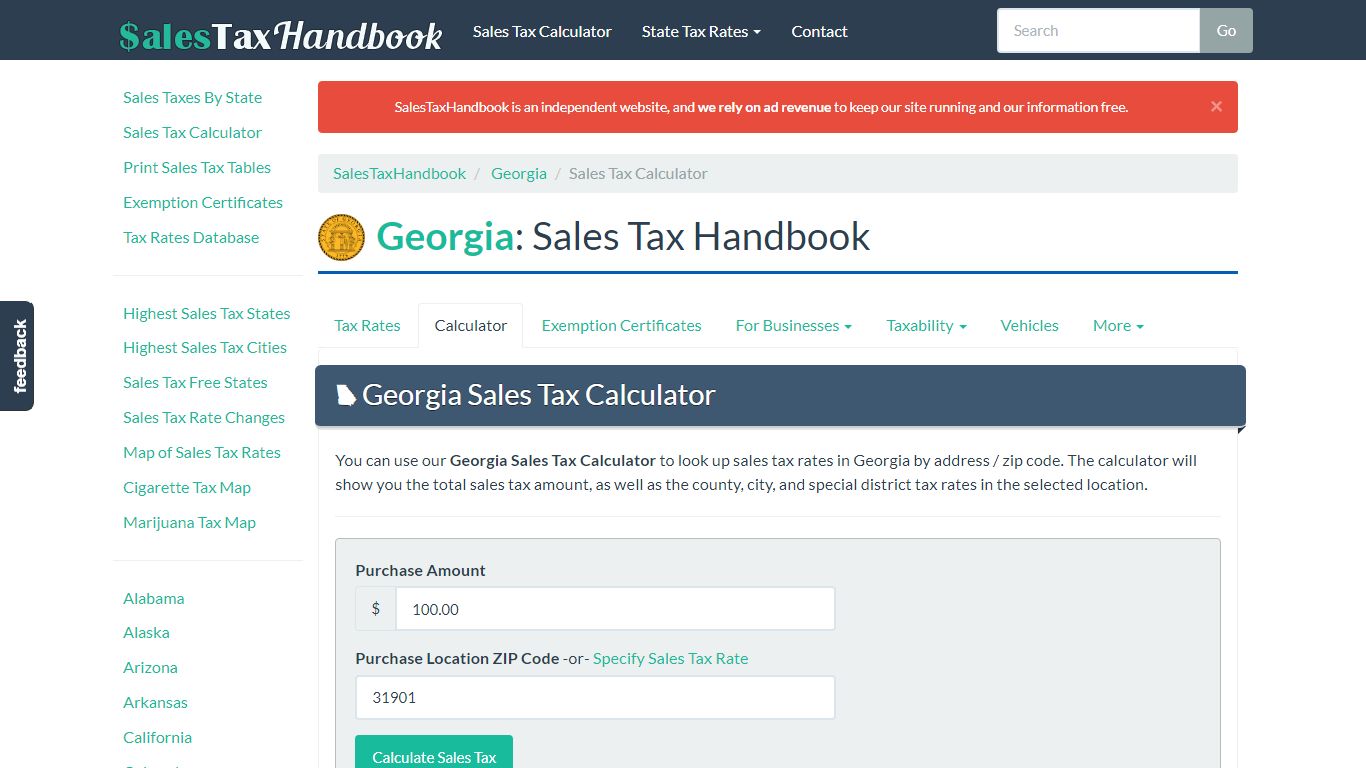

Georgia Sales Tax Calculator - SalesTaxHandbook

Georgia Sales Tax Calculator You can use our Georgia Sales Tax Calculator to look up sales tax rates in Georgia by address / zip code. The calculator will show you the total sales tax amount, as well as the county, city, and special district tax rates in the selected location. Purchase Location ZIP Code -or- Specify Sales Tax Rate

https://www.salestaxhandbook.com/georgia/calculator

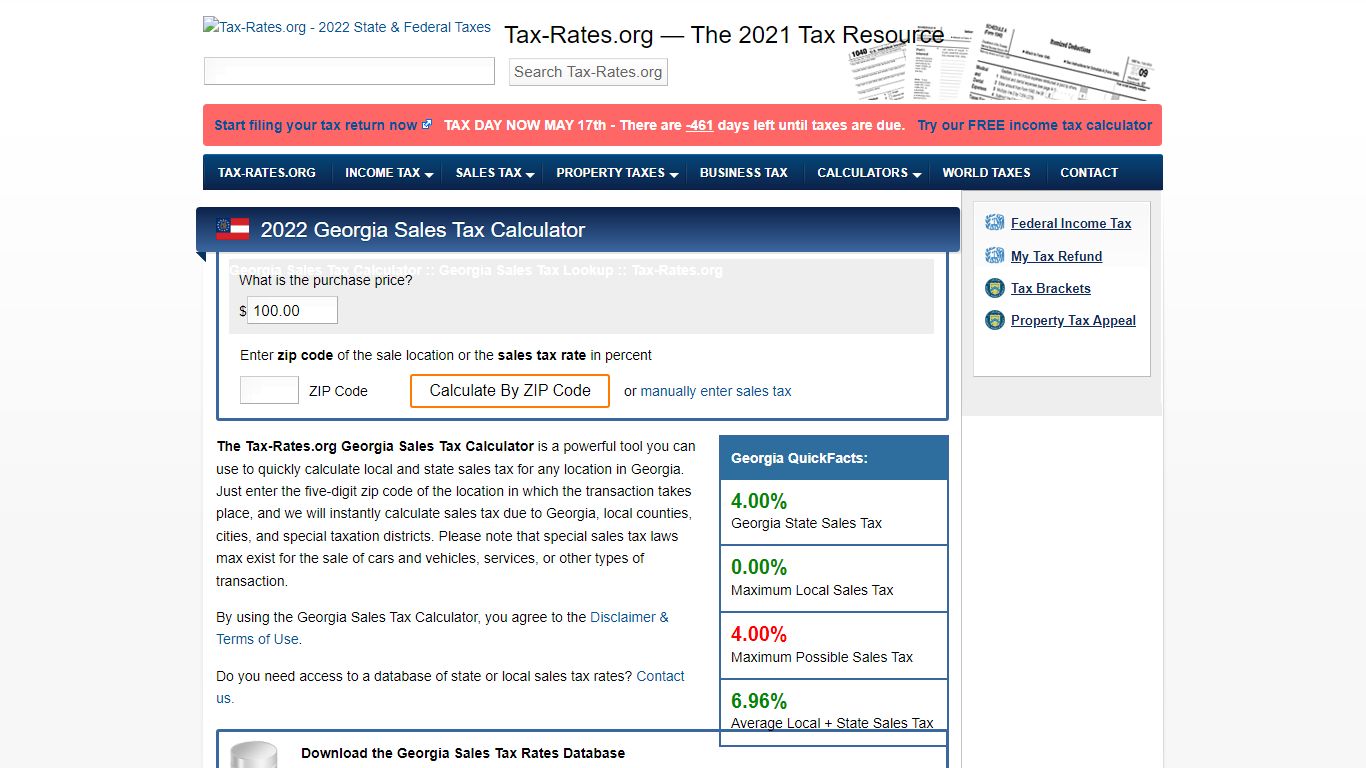

Georgia Sales Tax Calculator - Tax-Rates.org

Just enter the five-digit zip code of the location in which the transaction takes place, and we will instantly calculate sales tax due to Georgia, local counties, cities, and special taxation districts. Please note that special sales tax laws max exist for the sale of cars and vehicles, services, or other types of transaction.

https://www.tax-rates.org/georgia/sales-tax-calculator?action=preload

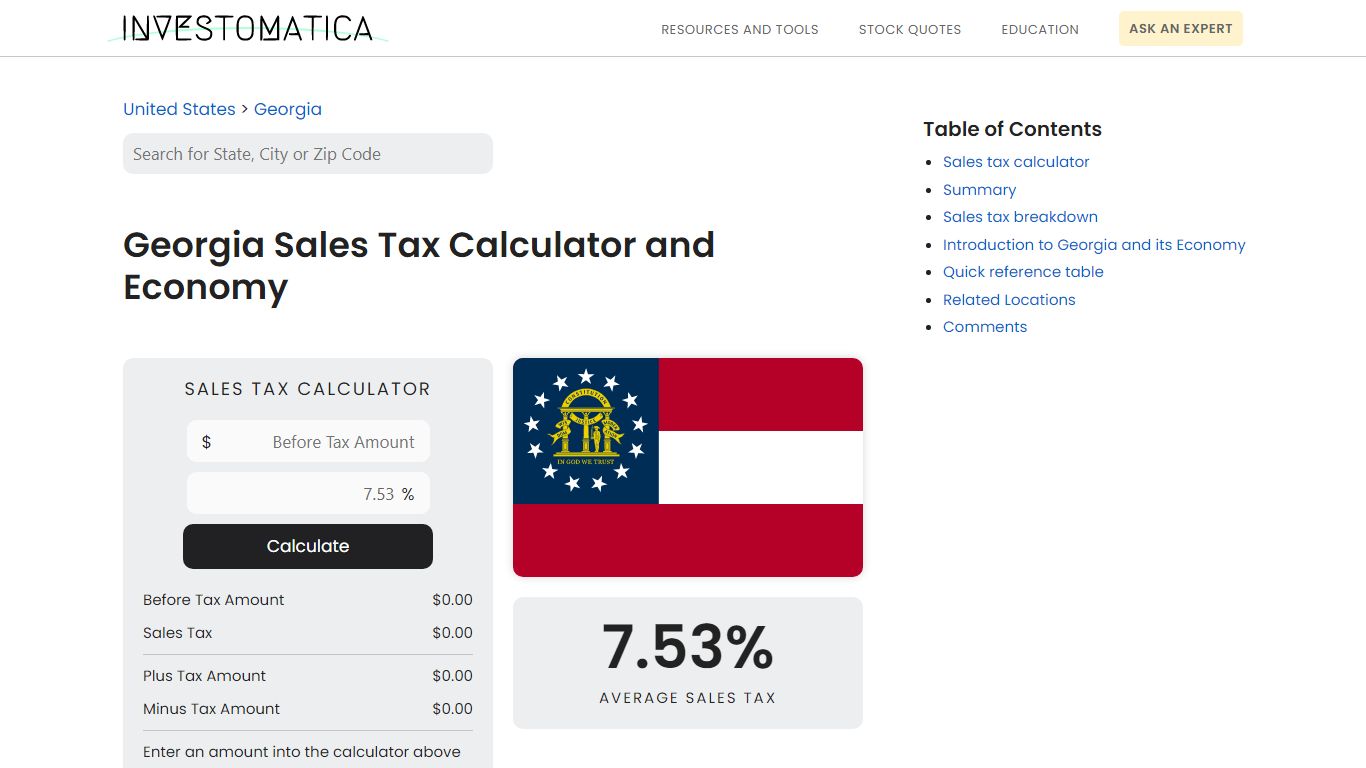

Georgia Sales Tax Calculator and Economy (2022) - Investomatica

Georgia Sales Tax Calculator and Economy Sales Tax Calculator Calculate Before Tax Amount $0.00 Sales Tax $0.00 Plus Tax Amount $0.00 Minus Tax Amount $0.00 Enter an amount into the calculator above to find out how what kind of sales tax you'll see in Georgia. You'll then get results that can help provide you a better idea of what to expect. 7.53%

https://investomatica.com/sales-tax/united-states/georgia

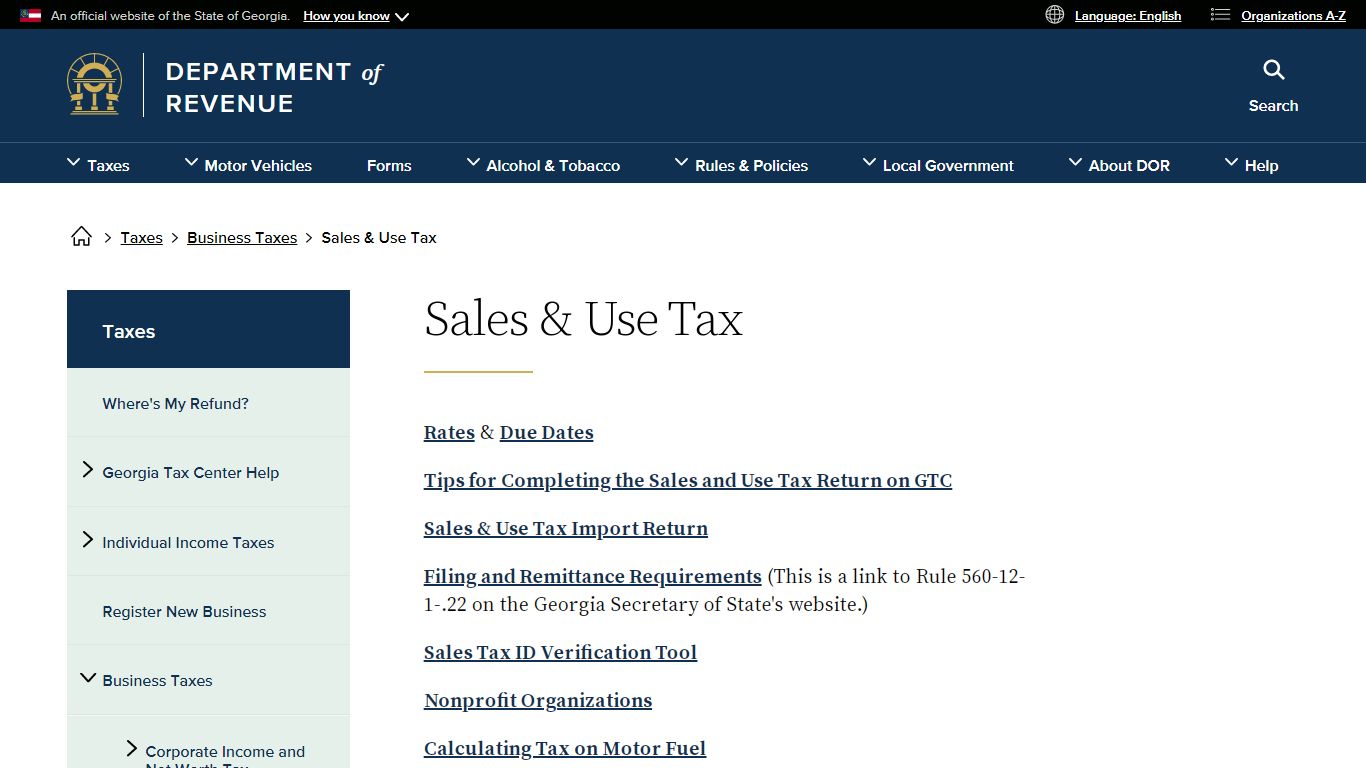

Sales & Use Tax | Georgia Department of Revenue

Sales & Use Tax. Rates & Due Dates. Tips for Completing the Sales and Use Tax Return on GTC. Sales & Use Tax Import Return. Filing and Remittance Requirements (This is a link to Rule 560-12-1-.22 on the Georgia Secretary of State's website.) Sales Tax ID Verification Tool. Nonprofit Organizations.

https://dor.georgia.gov/taxes/business-taxes/sales-use-tax

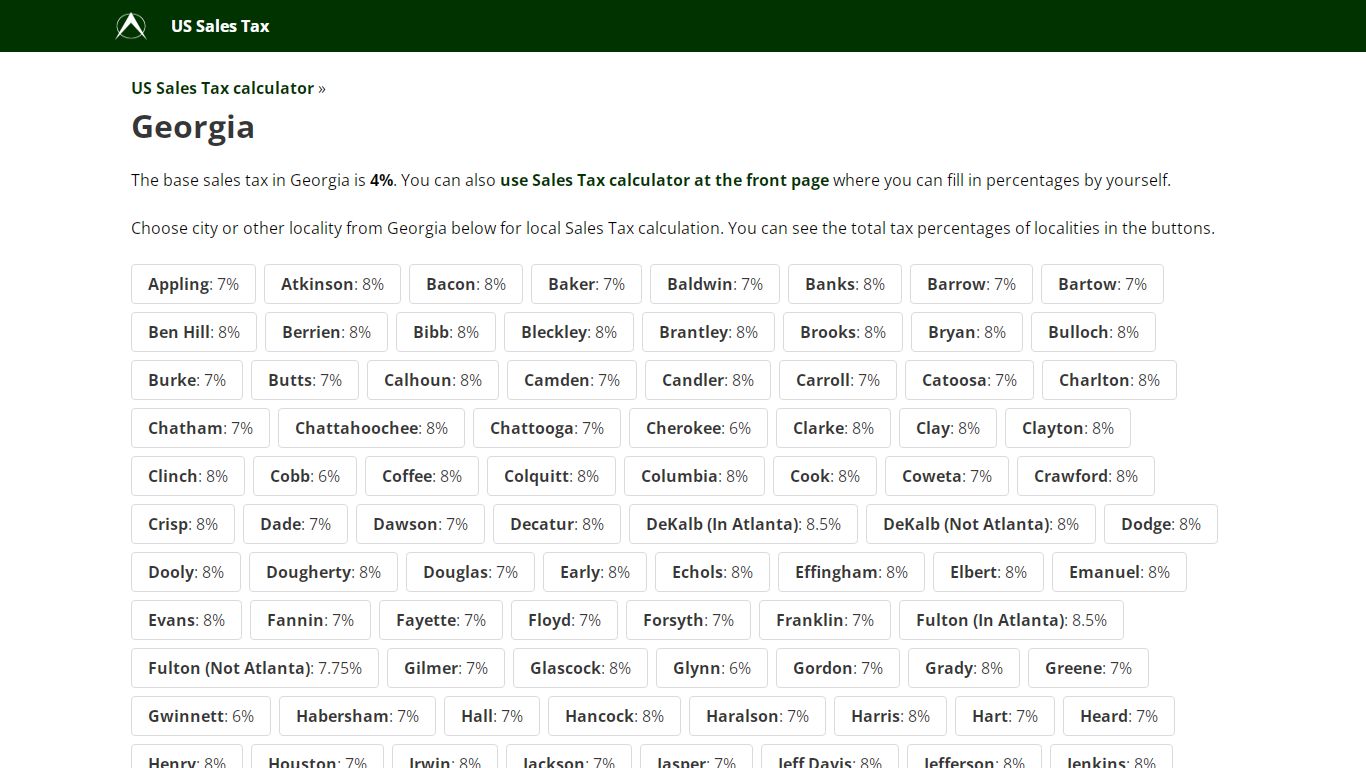

Georgia Sales Tax calculator, Georgia, US

The base sales tax in Georgia is 4%. You can also use Sales Tax calculator at the front page where you can fill in percentages by yourself. Choose city or other locality from Georgia below for local Sales Tax calculation. You can see the total tax percentages of localities in the buttons.

https://vat-calculator.net/us-sales-tax/georgia

Georgia Sales Tax Rate & Rates Calculator - Avalara

Georgia state sales tax rate range 4-9% Base state sales tax rate 4% Local rate range* 0%-5% Total rate range* 4%-9% *Due to varying local sales tax rates, we strongly recommend using our calculator below for the most accurate rates. Download state rate tables Get a free download of average rates by ZIP code for each state you select.

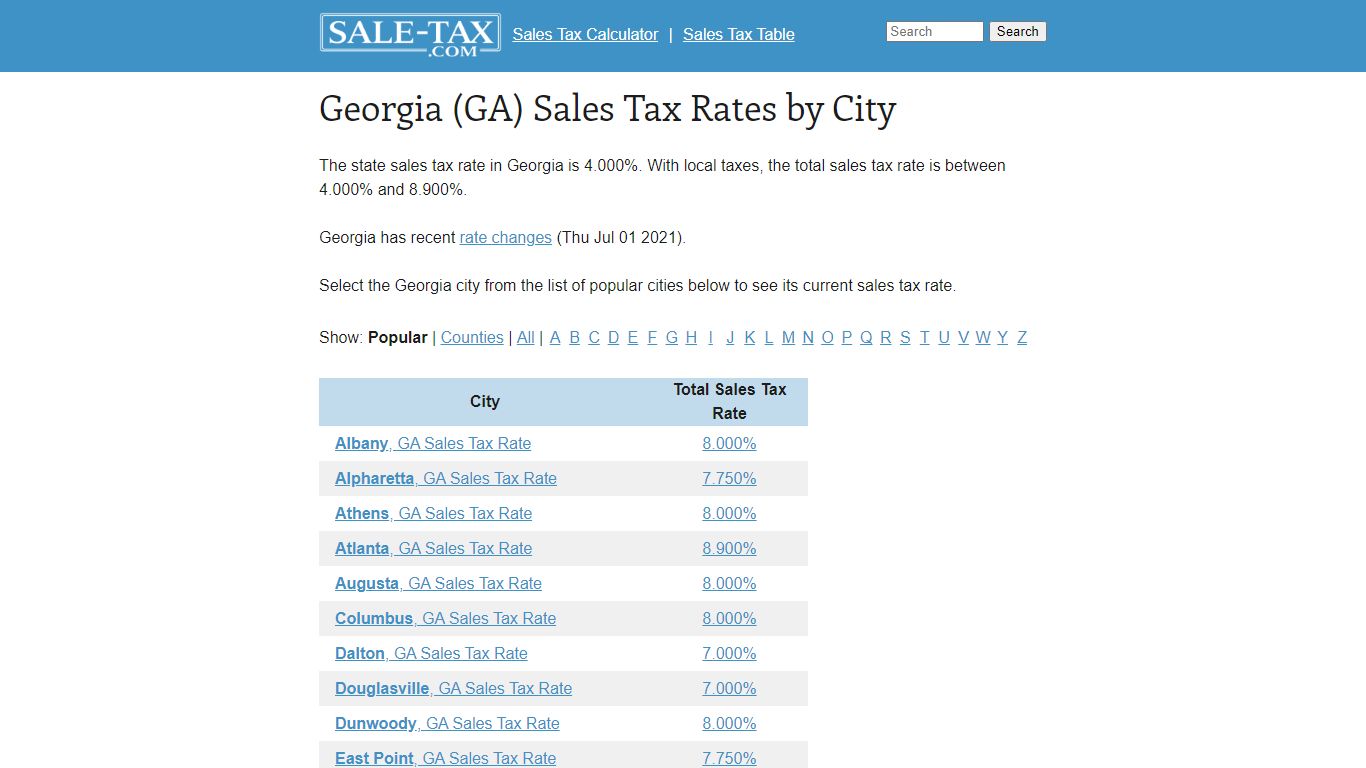

https://www.avalara.com/taxrates/en/state-rates/georgia.htmlGeorgia (GA) Sales Tax Rates by City - Sale-tax.com

Georgia (GA) Sales Tax Rates by City The state sales tax rate in Georgia is 4.000%. With local taxes, the total sales tax rate is between 4.000% and 8.900%. Georgia has recent rate changes (Thu Jul 01 2021). Select the Georgia city from the list of popular cities below to see its current sales tax rate.

https://www.sale-tax.com/Georgia

Use Ad Valorem Tax Calculator | Georgia.gov

The Ad Valorem calculator can also estimate the tax due if you transfer your vehicle to Georgia from another state. This tax is based on the value of the vehicle. The tax must be paid at the time of sale by Georgia residents or within six months of establishing residency by those moving to Georgia. Get started

https://georgia.gov/use-ad-valorem-tax-calculator

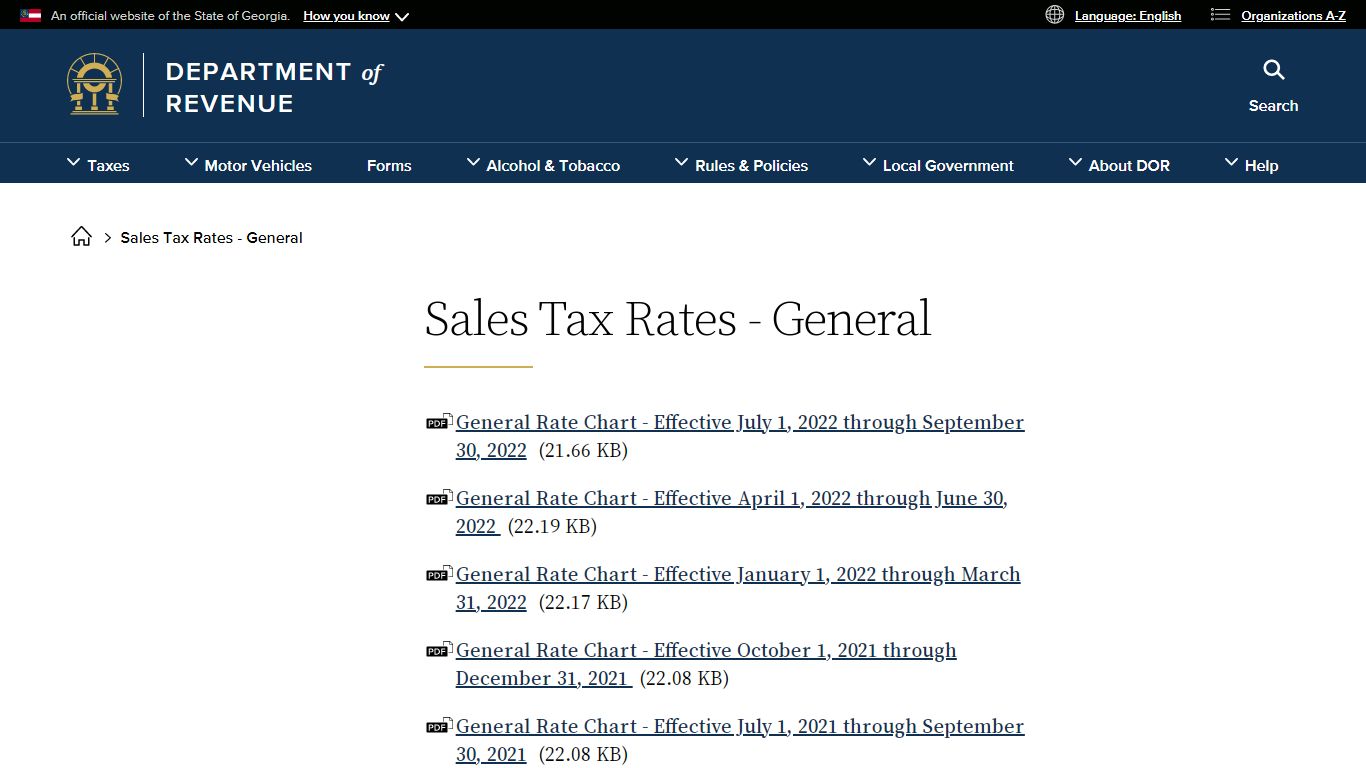

Sales Tax Rates - General | Georgia Department of Revenue

Sales Tax Rates - General. General Rate Chart - Effective July 1, 2022 through September 30, 2022 (21.66 KB) General Rate Chart - Effective April 1, 2022 through June 30, 2022 (22.19 KB) General Rate Chart - Effective January 1, 2022 through March 31, 2022 (22.17 KB) General Rate Chart - Effective October 1, 2021 through December 31, 2021 (22. ...

https://dor.georgia.gov/sales-tax-rates-general

Georgia Vehicle Sales Tax & Fees [+Calculator] - Find The Best Car Price

How to Calculate Georgia Tax on a Car You can calculate the Title Ad Valorem Tax by finding the fair market value of the vehicle and multiplying it by 6.6%. For example, imagine you are purchasing a vehicle for $45,000 but the fair market value is $40,000. You would pay 6.6% on the $40,000 amount, not the $45,000 you paid.

https://www.findthebestcarprice.com/georgia-vehicle-sales-tax-fees/![Georgia Vehicle Sales Tax & Fees [+Calculator] - Find The Best Car Price](./screenshots/georgia-sales-tax-calculator/9.jpg)